Source:- PIB & References etc.

Source:- PIB & References etc.

What is Black Money:- income illegally obtained or not declared for tax purposes.

What is Black Money:- income illegally obtained or not declared for tax purposes. Imposition of Tax Act, 2015 (UnFINA)

Imposition of Tax Act, 2015 (UnFINA) Unlike the VDIS 1997, the UnFINA-With both tax and penal rates-is not an amnesty scheme, which actually makes it a less effective tool in unearthing hidden offshore money, as the low compliance rate is associated with steep tax and penal provisions. In order to tap the remaining undeclared assets abroad, the Act can be modified, after a reasonable time-gap, to a mix of moderate tax rate with an infrastructure bond scheme (instead of the penal rates) which would then serve both the achievement of its original purpose to a greater extent and meeting the country’s infrastructure gap as well.

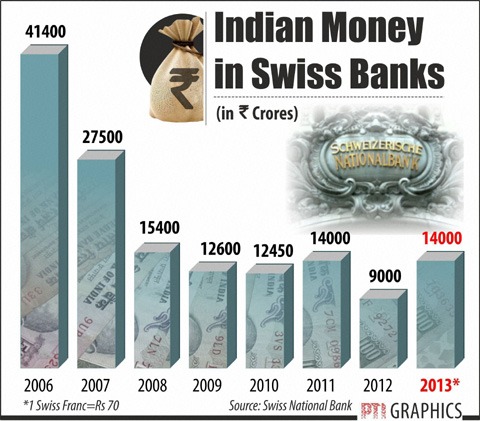

Unlike the VDIS 1997, the UnFINA-With both tax and penal rates-is not an amnesty scheme, which actually makes it a less effective tool in unearthing hidden offshore money, as the low compliance rate is associated with steep tax and penal provisions. In order to tap the remaining undeclared assets abroad, the Act can be modified, after a reasonable time-gap, to a mix of moderate tax rate with an infrastructure bond scheme (instead of the penal rates) which would then serve both the achievement of its original purpose to a greater extent and meeting the country’s infrastructure gap as well. 1.Constitution of a Special Investigation Team (SIT) (2014) on the Supreme Court order (2011) for a comprehensive action plan against generation and stashing away of unaccounted money in foreign banks, or in various forms domestically;

1.Constitution of a Special Investigation Team (SIT) (2014) on the Supreme Court order (2011) for a comprehensive action plan against generation and stashing away of unaccounted money in foreign banks, or in various forms domestically; 6.Agreement on Foreign Account Tax Compliance Act (FATCA) with the USA will ensure reporting by both the countries on tax information by foreign financial institutions operating in each other’s territory;

6.Agreement on Foreign Account Tax Compliance Act (FATCA) with the USA will ensure reporting by both the countries on tax information by foreign financial institutions operating in each other’s territory;